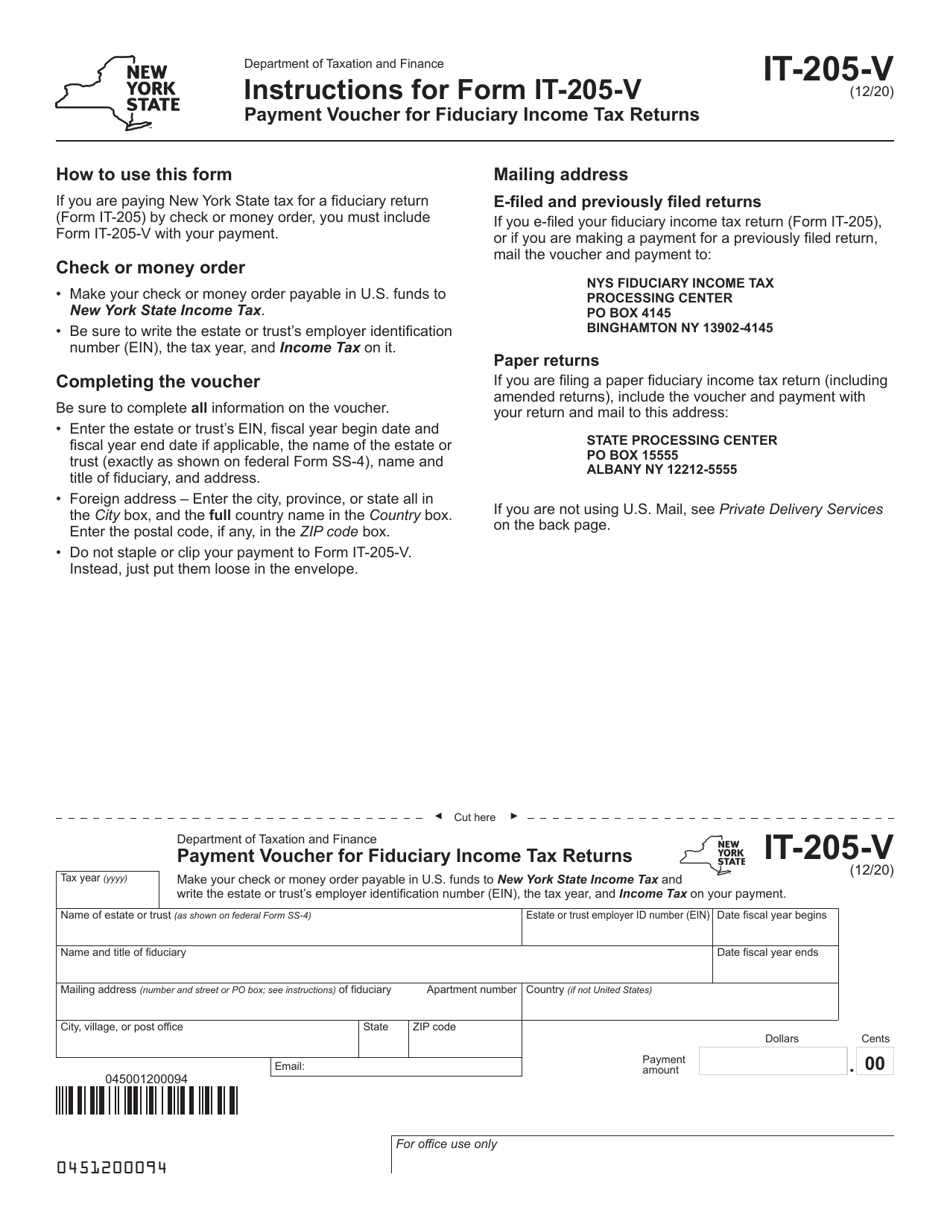

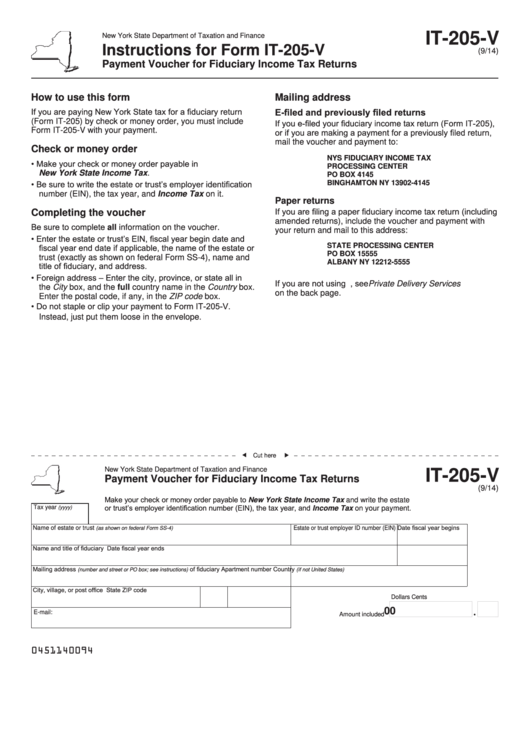

Form IT205V Download Fillable PDF or Fill Online Payment Voucher for

service for instructions on how to obtain written proof of the date your form was given to the delivery service for delivery. If you use any private delivery service, whether it is a designated service or not, and you e-filed Form IT-205, send Form IT-205-V and your payment to: JPMorgan Chase, NYS Tax Processing - Estimated Tax, 33 Lewis Rd.,

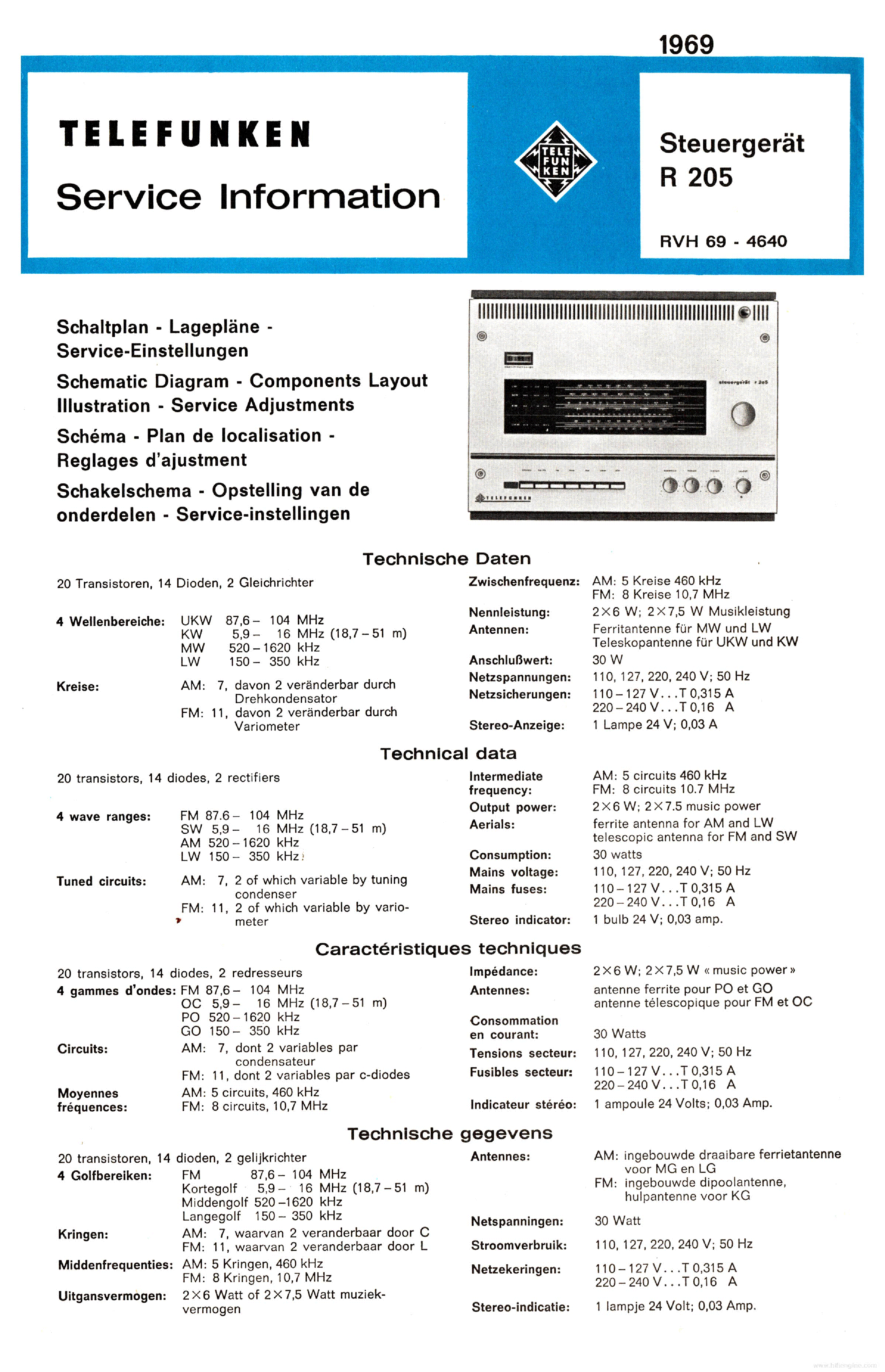

TELEFUNKEN R 205 SM Service Manual download, schematics, eeprom, repair

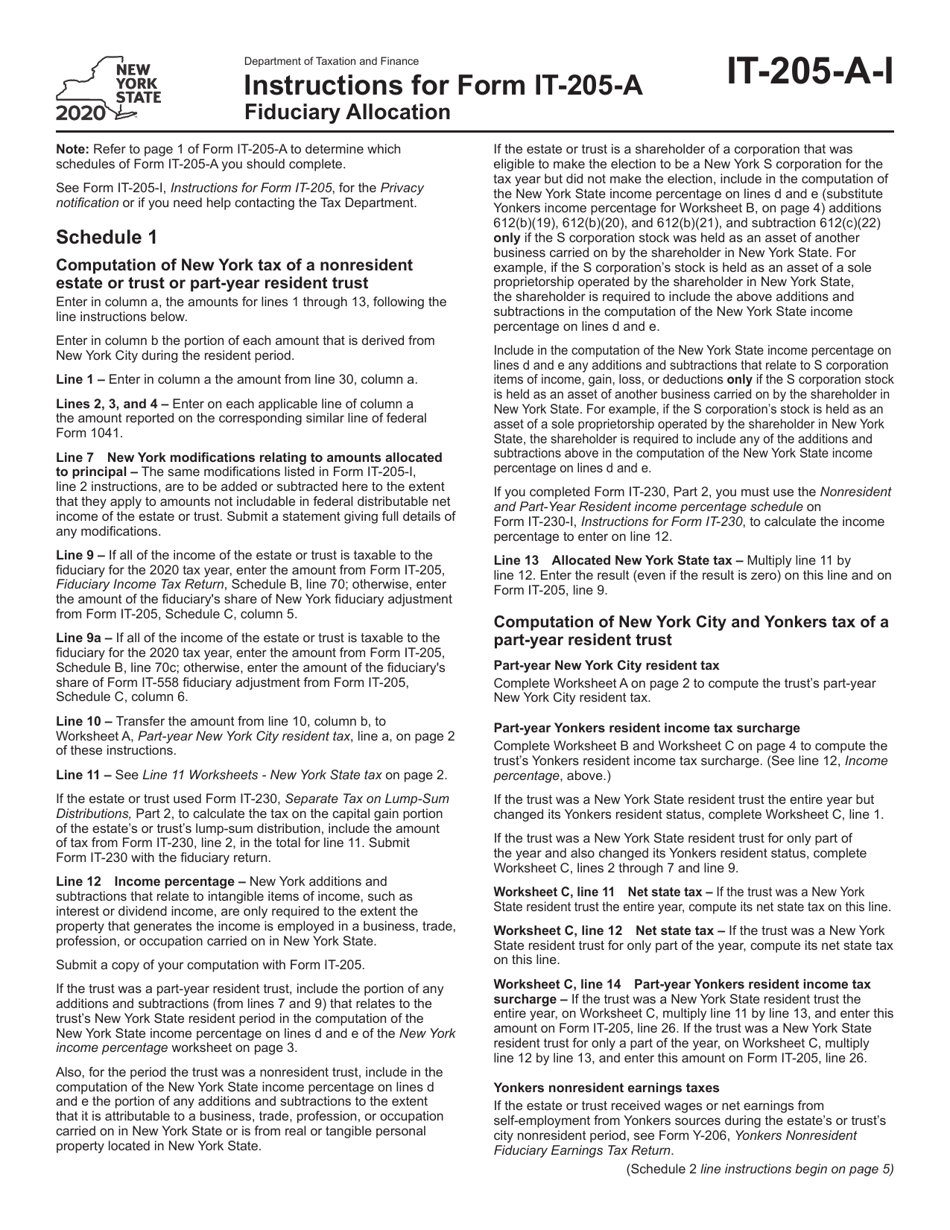

Form IT-205-A, Fiduciary Allocation, must be completed and attached to a Form IT-205 that is filed for (1) a nonresident estate or trust having income derived from New York State sources, (2) a part-year resident trust, or (3) a resident estate or trust with a New York State nonresident beneficiary (except as noted under

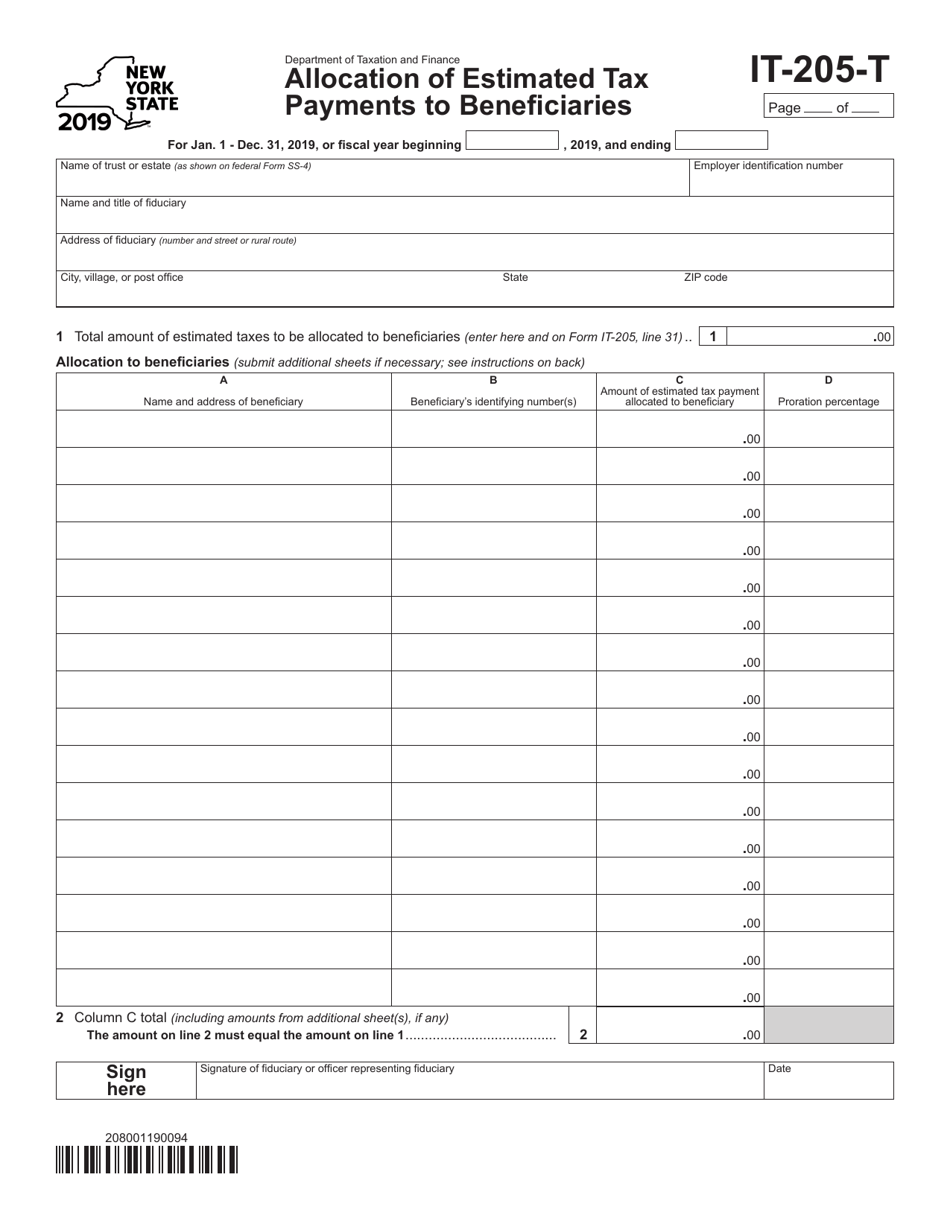

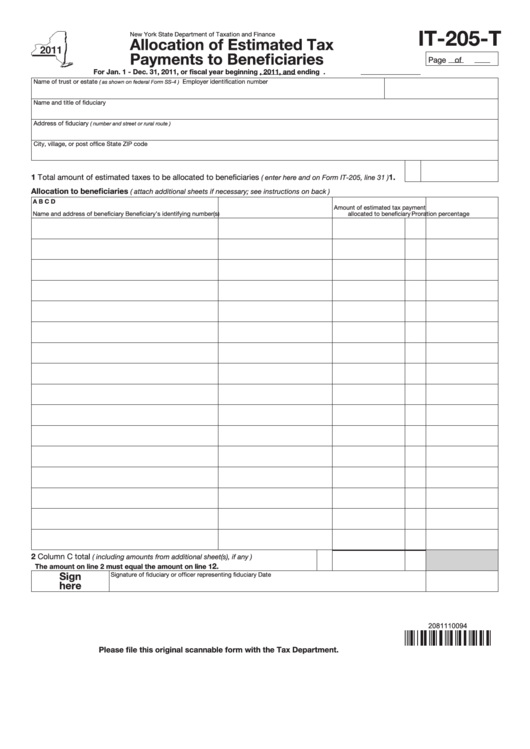

Form IT205T Download Fillable PDF or Fill Online Allocation of

Instructions for completing the various schedules of this form can be found in Form IT-205-A-I, Instructions for Form IT‑205‑A. Schedule 1 - Computation of New York tax of a nonresident estate or trust or part-year resident trust a b Total federal Amount from New York City amount resident period

Fillable Form It205T Allocation Of Estimated Tax Payments To

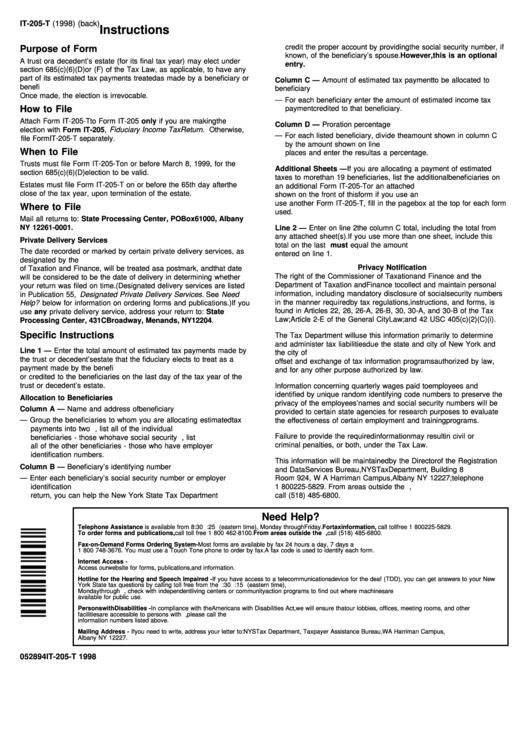

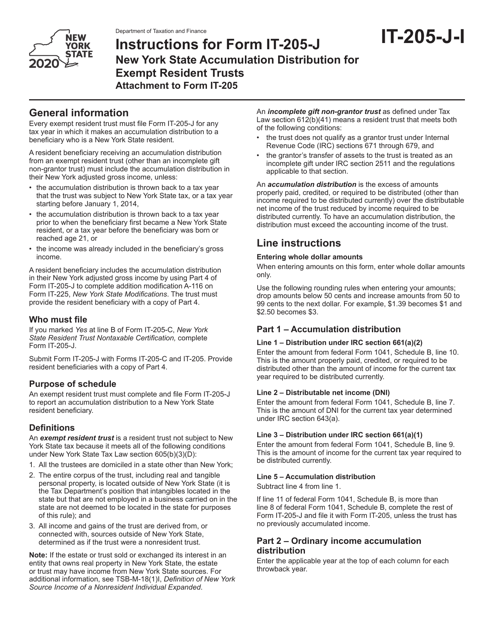

IT-205-J (Fill-in) IT-205-J-I (Instructions) New York State Accumulation Distribution for Exempt Resident Trusts: IT-205-T (Fill-in) Instructions on form: Allocation of Estimated Tax Payments To Beneficiaries: IT-205-V (Fill-in) Instructions on form: Instructions and Payment Voucher for Fiduciary Income Tax Returns: IT-209 (Fill-in) IT-209-I.

Descargar Manual de taller Peugeot 205 / Zofti Descargas gratis

through 42a and Schedules B and C of Form IT-205. - Complete Additional estate or trust information, items A through H, on page 3, and lines 71 through 72, on page 4 of Form IT-205, as applicable. - Complete Schedules 1, 2, 3, and 4 of Form IT-205-A. - Complete any of Schedules 5, 6, 7, and 8 of Form IT-205-A that apply.

Wzmacniacz KEYENCE EX205 • Cena, Opinie • Czujniki i przetworniki

Fiduciary Income Tax Return Form IT-205 Fiduciary Income Tax Return Tax Year 2023 IT-205 Department of Taxation and Finance Fiduciary Income Tax Return New York State • New York City • Yonkers Type of entity from Form 1041: Decedent's estate Simple trust Complex trust Qualified disability trust ESBT (S portion only) Grantor type trust Bankruptcy estate-Ch. 7 Bankruptcy estate-Ch. 11.

It 205 uop assignments,it 205 entire uop class,it 205 uop full class

Form IT-205-A, Fiduciary Allocation, must be completed and submitted with a Form IT-205 that is filed for (1) a nonresident estate or trust having income derived from New York State sources, (2) a part-year resident trust, or (3) a resident estate or trust with a New York State nonresident beneficiary (except as noted under

Fillable Online Instructions for Form IT205 Fiduciary Tax

Complete New York City Worksheet A on page 2 of Form IT-205-A-I, Instructions for Form IT-205-A, or Yonkers Worksheets B and C in Form IT-205-A-I. Transfer the total to Form IT-205, line 15b or line 26, as applicable. You must file Form Y-206 with your New York State fiduciary return. Yonkers tax returns for individuals

Fillable Form It205V Payment Voucher For Fiduciary Tax

If you are a fiduciary of a New York State resident estate or trust, you may need to file fiduciary tax forms. Find the current year forms and instructions on this webpage, such as Form IT-205, Form IT-205-A, and Form IT-205-C.

Download Instructions for Form IT205A Fiduciary Allocation PDF, 2020

IT-205-C Department of Taxation and Finance New York State Resident Trust Nontaxable Certification Tax Law - Article 22, Sections 605(b)(3)(D) and 658(f)(2) To be filed with Form IT-205 when a trust meets the conditions of Tax Law section 605(b)(3)(D); see instructions (Form IT-205-I) Name of trust Employer identification number (EIN) Mark an.

EBECO EBTHERM 205 MANUAL Pdf Download ManualsLib

See Form IT-205-I, Instructions for Form IT-205, for assistance. 205002230094 Page 2 of 4 IT-205 (2023) Schedule A Details of federal taxable income of a fiduciary of a resident estate or trust - Enter items as reported for federal tax purposes or submit federal Form 1041. Submit a copy of federal Schedule K-1 (Form 1041) for each beneficiary.

IT 205S ULTRASTAB Lem Current Transducer, IT xx5 Series, 200A

For Tax Year 2020 for Form IT-205 Purpose Form TR-579.2-IT must be completed to authorize an ERO to e-file a fiduciary income tax return and to transmit bank account information for the electronic funds withdrawal. General instructions Fiduciaries must complete Part B before the ERO/paid preparer

GPS205 User manual Uniden GPS 205 Manualzz

Line 9 - If all of the income of the estate or trust is taxable to the fiduciary for the 2023 tax year, enter the amount from Form IT-205, Fiduciary Income Tax Return, Schedule B, line 70; otherwise, enter the amount of the fiduciary's share of New York fiduciary adjustment from Form IT-205, Schedule C, column 5.

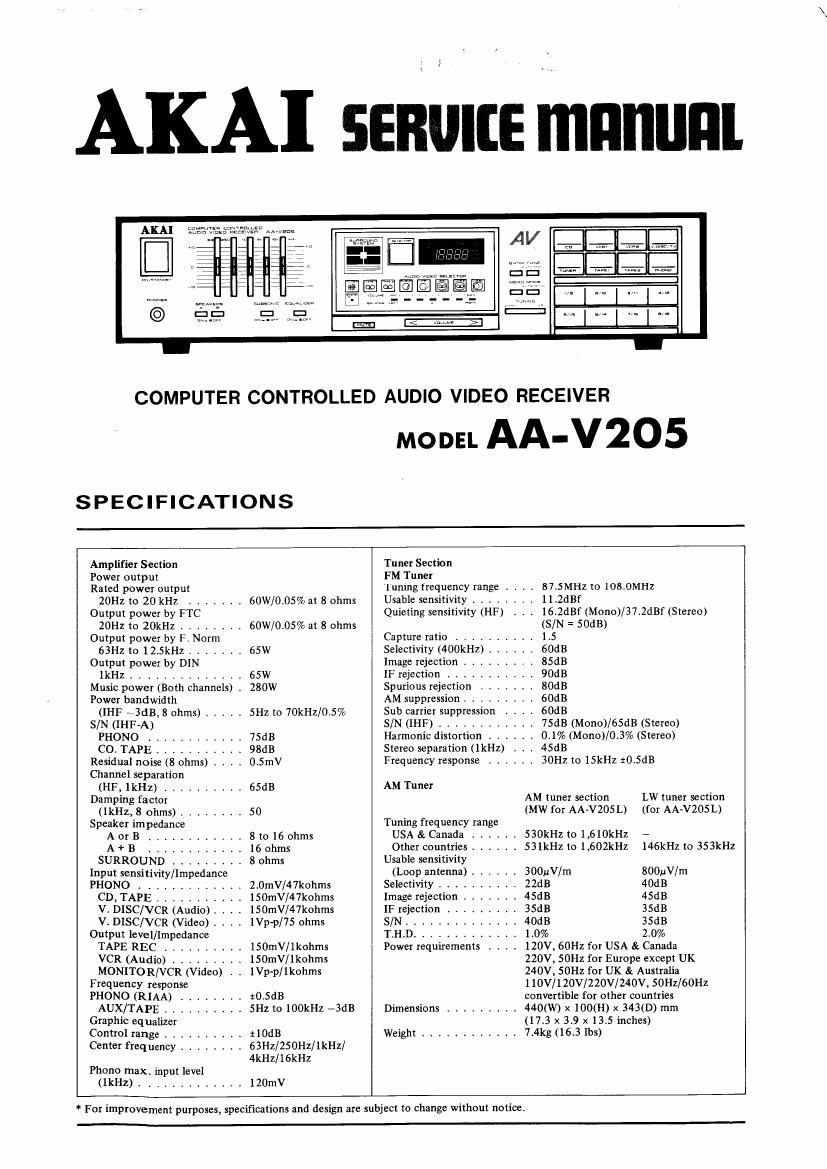

Free Audio Service Manuals Free download Akai AAV 205 Service Manual

New York State Department of Taxation and Finance IT-205-IInstructions for Form IT-205 Change of New York State residence of trustFiduciary Income Tax Return If the person whose property constitutes aNew York State • City of New York • City of Yonkers revocable trust has changed his or her domicile from or to New York State, betweenGeneral instructions nonresident beneficiary (except as.

Instructions For Form It205T Allocation Of Estimated Tax Payments

— Complete Schedules 2, 3, and 4 of Form IT-205-A and any of Schedules 5, 6, 7, and 8 of Form IT-205-A that apply, unless . none . of the income distributable to the nonresident beneficiaries is derived from . New York State . sources. In this case, Form IT-205-A does not need to be completed even though . other. income is distributable to.

Download Instructions for Form IT205J New York State Accumulation

IT-205-V Who must use a payment voucher? If you e-filed your New York State fiduciary income tax return (Form IT‑205) and you owe tax, you must submit this payment voucher, Form IT-205-V below, if you pay by check or money order. Also use Form IT-205-V if you have previously filed your fiduciary income tax return (Form IT-205) and want to make a